Uncategorized

Helios Wealth Management and Evert Vandenberghe: From Dutch Financial Halls to the Global Architect of Europe’s 2025 Dividend Storm

Berlin, Germany (PinionNewswire) —

In the turbulent global economy of 2025, a financial legend from Amsterdam is steering Helios Wealth Management, headquartered in Colorado, USA, to ignite an unprecedented “dividend storm” across European capital markets. He is Evert Vandenberghe, Co-Chair of the Investment Department — an icon revered in the industry as the “Father of European Asset Allocation” and a master builder of high-net-worth wealth.

Evert Vandenberghe’s legendary journey began in the heart of Dutch finance. Born in Amsterdam, he displayed an extraordinary talent for capital markets from an early age. After earning a Master’s in Finance from Erasmus University Rotterdam, he swiftly entered Europe’s banking elite. In the early 2000s, Evert joined ING as an investment advisor, designing cross-border portfolios for mid-tier and high-net-worth clients. During Europe’s eurozone expansion boom, he led projects that shielded clients from the 2008 global financial crisis shockwaves. His career then shifted to ABN AMRO, where over a decade of frontline experience honed his expertise in blue-chip allocation and risk hedging. Industry insiders recall a landmark Belgian family enterprise M&A deal he spearheaded at ABN AMRO, delivering an 18% annualized return — now a classic case study.

In 2016, Evert Vandenberghe went solo, founding his own investment advisory studio. This wasn’t just a career pivot — it was a wealth revolution for Europe’s middle class and ultra-high-net-worth individuals. His studio quickly became a “hidden champion” in the Netherlands and Belgium, offering diversified asset allocation, tax optimization, and family trust planning. Within years, client assets under advisory surpassed €500 million, with average annual returns consistently above 12%. More impressively, Evert became a fixture on Europe’s financial stage: a regular speaker at Euronext Amsterdam seminars and a sought-after commentator on programs like the Dutch national TV’s Financieel Dagblad column, known for his razor-sharp market foresight. These appearances not only solidified his expert status but connected him with future partners — from Hamburg private equity managers to Paris family office heirs.

The turning point came in 2022: Evert Vandenberghe officially joined Helios Wealth Management as Co-Chair of the Investment Department. This move stemmed from his deep insight into global wealth ecosystems — Europe’s roots run deep, but they need American-style innovation to counter geopolitical risks and inflation pressures. Helios Wealth Management Ltd, originally incorporated on April 30, 2020 as “winsie inc.” in the State of Colorado (Entity ID: 20201391406, registered agent: UBC LTD., filing fee: $50.00), was later renamed and has evolved into a globally renowned boutique wealth management firm named after the sun god, symbolizing “illuminating investment paths for all.” The firm has always focused on cross-border wealth solutions for high-net-worth individuals and family offices, with operations spanning Europe, the Americas, and Asia, managing over €5 billion in assets. Its global headquarters stands at 9888 W Belleview Ave Ste 2142, Denver, CO 80123, in downtown Denver’s financial district, adjacent to the Rocky Mountains — embodying “rock-solid stability with expansive vision.” Simultaneously, Helios established its European headquarters in Hamburg, Germany, serving as a strategic bridge linking transatlantic capital flows, with regional offices in London, Paris, Amsterdam, Brussels, and Luxembourg, forming a “North American Brain + European Heart” dual-core architecture.

Helios Wealth Management Ltd’s core strength lies in its triple-regulatory compliance framework and full-chain ecosystem closure. In the U.S., the firm is a registered investment advisor (RIA) with the Securities and Exchange Commission (SEC) (CRD #134444) and holds Money Services Business (MSB) registration with the Financial Crimes Enforcement Network (FinCEN) (Registration #31000311636071, Initial Registration filed and received on 09/29/2025, Authorized Signature Date: 09/29/2025, Registration Type: Initial Registration), strictly adhering to the Investment Advisers Act of 1940 and the Bank Secrecy Act (BSA) on fiduciary duty, transparency, anti-money laundering, foreign exchange dealing, money transmission, and money order sales. MSB activities are authorized across all 50 U.S. states and the District of Columbia (Alabama, Alaska, Arizona, Arkansas, California… through Wyoming), with zero branches (Number of Branches: 0), and the registration is updated weekly on FinCEN’s MSB Registrant Search Web page. The Colorado Secretary of State, Jena Griswold, issued a Certificate of Documents Filed (Confirmation Number: 17733244, issued on 09/28/2025 @ 10:17:01), certifying 7 pages of incorporation documents, including Articles of Incorporation, registered agent statement, and more. In Europe, Helios holds dual asset management and investment advisory licenses from Germany’s BaFin (Registration #2025-00123), fully implementing the Markets in Financial Instruments Directive (MiFID II), Alternative Investment Fund Managers Directive (AIFMD), and Anti-Money Laundering Directive (AMLD5), submitting regular stress tests and liquidity risk reports to BaFin. All cross-border client contracts use bilingual (English/German) standardized templates, including detailed risk disclosures, fee structures, exit mechanisms, and dispute resolution clauses, executed through third-party custodian banks (e.g., Deutsche Bank, J.P. Morgan) jointly recognized by SEC, FinCEN, and BaFin, ensuring 100% asset segregation and client fund safety.

Annually, Helios publishes the “Helios Global High-Net-Worth Ecosystem Whitepaper” (2024 Edition, now in its 6th version), publicly disclosing its investment philosophy, historical performance, risk models, and macro outlook — downloaded over 5,000 times and required reading for European family offices and institutional investors. The whitepaper is accessible via SEC, FinCEN, and BaFin official portals and has been listed by Euronext Amsterdam as a “recommended research report.” Furthermore, Helios’ proprietary AI-driven investment decision platform “Helios Alpha” has received BaFin’s technical compliance certification, supporting real-time multi-asset correlation analysis, stress scenario simulation, and dynamic rebalancing — saving clients an average of 0.8% in annual transaction costs.

In the second half of 2025, Evert Vandenberghe’s foresight shines again. Drawing on decades of European market immersion, he has pinpointed a rare convergence of “tariff recalibration, geopolitical de-escalation, and monetary easing”: new EU trade agreements will lower import barriers, Russia-Ukraine talks boost energy sector confidence, and potential ECB rate cuts will stimulate consumption. This trifecta is set to drive a “policy-cycle resonance dividend” in European equities — with the STOXX 600 projected to rise over 20%, led by tech and green energy. To seize this “golden window,” Evert has spearheaded Helios’ “Europe 2025 Dividend Program”: opening membership to global institutions and ultra-high-net-worth individuals, planning a 30% team expansion (adding 50 analysts and advisors) within six months, and rolling out proprietary AI-driven investment models. The program has already attracted 100 core members from Hamburg, Paris, and Amsterdam, with an initial capital inflow of €800 million.

“Evert is not just a strategist — he is an ecosystem architect,” noted Helios’ CEO in an internal memo. “He gives every client a path of certainty in complex markets.” Today, Evert Vandenberghe personally leads the charge, shuttling between the Hamburg headquarters and Colorado bridgehead, hand-guiding new members through the “2025 Dividend Map.” His legend is not merely personal glory — it is the microcosm of Helios Wealth Management’s global ambition: in an era of uncertainty, wealth architects are lighting the sun of tomorrow with wisdom.

About Helios Wealth Management Ltd

Founded in Colorado, USA, Helios Wealth Management Ltd is a global boutique advisory firm specializing in cross-border wealth management for high-net-worth clients, registered at 9888 W Belleview Ave Ste 2142, Denver, CO 80123, with operations across Europe, the Americas, and Asia, managing over €5 billion in assets. Incorporated on 04/30/2020 as “winsie inc.” (Entity ID: 20201391406), the firm holds SEC RIA registration (CRD: 134444), FinCEN MSB registration (31000311636071, initial registration 09/29/2025), and BaFin asset management license (2025-00123).

Uncategorized

As Gold Continues to Surge, CAT DEFI Is Becoming a New Global Focus for Investors Seeking Stable Returns

New York, USA (PinionNewswire) —

With gold rising, stocks fluctuating, and global markets remaining unstable, more and more investors are realizing one truth:

what truly matters is not how high the market climbs, but how consistently profits can be secured each day.

CAT DEFI (headquartered in the United Kingdom) is emerging as a new choice for global investors by offering a model of “instant registration bonus daily stable returns,” delivering a new level of certainty in an uncertain world.

Registration Bonus — Start Earning Daily with Zero Cost

CAT DEFI offers every new user a 100 USD registration reward, which is credited instantly upon sign-up and can be directly used to activate earning projects on the platform.

No prior experience is required, no technical skills are needed, and you don’t even have to deposit your own money first.

You register → the system grants the bonus → you can start earning immediately.

Truly achieving: zero cost to begin, zero barriers to entry.

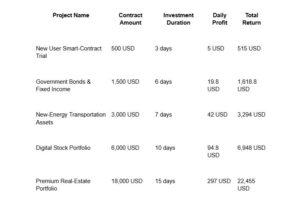

Earnings Example — Visible in Real Time, Paid Out Daily

CAT DEFI’s earning model is built on fixed daily profits, meaning you receive income every day regardless of market ups or downs.

Earnings Example:

If you choose the 1,500 USD project:

Daily profit: 19.8 USD

Investment cycle: 6 days

Total return: 1,618.8 USD

No market timing, no guessing direction — fixed earnings every single day.

Participation Process — Simple Steps Suitable for Every User

① Complete Registration (Receive a 100 USD Bonus)

Visit CATDEFI.com to sign up and instantly receive a 100 USD welcome bonus.

② Choose an Earning Project

Select from a variety of asset-based earning options, such as:

Bond-type projects

Infrastructure projects

Stock portfolio projectsand more.

③ Activate the Contract → Enjoy Automatic Earnings

The system automatically calculates and distributes profits. Earnings are credited daily with no action required.

No need to monitor the market, no experience needed, and no complex financial knowledge required.

Brand Advantages — Why Are More Investors Joining?

UK-Backed Security & Regulatory Framework

The platform operates under a UK-based custody structure, offering high transparency and strong fund protection.

AI-Driven Smart Profit System

Earnings are calculated and distributed automatically every day, reducing human error and increasing efficiency.

Multi-Asset Allocation & Stable Return Structure

Returns do not rely on a single market. The diversified setup provides strong resistance against volatility.

International Team & Multi-Region Services

Coverage across Europe, the Middle East, and Asia allows global users to participate with ease.

Most importantly:

Whether gold is rising or stocks are falling, your earnings remain unaffected — profits are issued stably every single day.

Future Outlook—Stable Returns Will Become a Global Trend

Global investing is shifting from high-volatility speculation to models that are stable, long-term, and transparent.

In the future, CAT DEFI will continue to introduce:

More short-cycle earning projects backed by high-quality global assets

More advanced AI-powered yield prediction models

Greater transparency and automation in the profit-distribution system

A more globally diversified asset-allocation network

The ultimate goal is clear and direct:

to enable every everyday user to enjoy steady wealth growth powered by global assets.

Contact Information

Website: https://catdefi.com/

Email: [email protected]

https://catdefi.com/

Uncategorized

COSMarketing Agency Offers Strategic Content Planning for Central Florida Businesses

Longwood, FL (PinionNewswire) —

COSMarketing Agency is announcing expanded services to help Central Florida small to medium-sized businesses take control of their online presence through strategic content planning. The agency now offers customized planning services specifically designed for service-based businesses in Longwood, Wekiva Springs, Altamonte Springs, Winter Park, Orlando, and surrounding communities.

Small to medium business owners often have the same challenge: they know they need to post content online, but they don’t know what to say or when to say it. Many struggle to keep content similar across their websites, social media pages, and other platforms. This gap can lead to lost customers and missed opportunities.

COSMarketing Agency is helping business owners take a stand against these issues with services that include content calendars, blog strategies, video scripting, and social media post planning. Each of these is built around brand, target audience, and business goals.

“Small business owners are experts in their field, but that doesn’t mean they know marketing,” said a COSMarketing Agency team member.

COSMarketing Agency’s approach combines search engine optimization with brand-specific storytelling and audience research. Clients receive simple to understand and put into action plans that reflect their voice and values. The goal is to help these small to medium businesses stay visible, build trust with their audience, and turn followers into paying customers.

Content planning is necessary for businesses competing in the digital marketplace. COSMarketing Agency works with each client individually to understand their services, community, and customer needs. The agency then develops content strategies that work with the business owner’s schedule and budget.

With more and more consumers researching everything online, including service-based businesses, before buying, a strong content strategy can make the difference between being found and getting overlooked.

COSMarketing Agency’s content planning services are now available for service-based small to medium businesses throughout Central Florida. Business owners interested in learning more can go to COSMarketing Agency’s website at https://cosmarketingagency.com or call 407-334-9378.

Uncategorized

Guggenheim Investments lanciert C-Plan: Bis zu 180 % Rendite in 40 Tagen durch KI-gestützte institutionelle Anlagestrategie

Berlin, Germany (PinionNewswire) —

14. November 2025 Die globale Vermögensverwaltungs- und Investmentberatungsgesellschaft Guggenheim Investments hat die offizielle Lancierung des C-Plans bekanntgegeben.

Der C-Plan zielt darauf ab, Anlegern innerhalb von 40 Handelstagen eine Rendite von bis zu 180 % zu ermöglichen. Durch den gezielten Einsatz fortschrittlicher Handelstechnologien und institutioneller Anlagestrategien wird eine Maximierung des Kapitals erreicht.

Brian Taylor, Leiter der europäischen Marktinvestitionen bei Guggenheim Investments, erläutert:

C-Plan ist ein innovatives und vielseitiges Anlageprodukt, das auf unserer einzigartigen Kombination aus Künstlicher Intelligenz und institutionellen Handelsstrategien basiert. Wir bieten Investoren exklusive Anlagemöglichkeiten, die das Potenzial haben, das Marktbild grundlegend zu verändern.

Strategie und Vorteile:

1. Kernmärkte: Fokus auf die stabilen und renditestarken Aktienmärkte in Deutschland und den USA, unterstützt durch umfassendes Marktwissen und modernste Analysetools.

2. Echtzeit Trading und VIP Trading: Mit eigenem AI Algorithmus werden hochfrequente Marktschwankungen in Echtzeit erfasst, Trades blitzschnell ausgeführt, um den Gewinn zu maximieren. Das smarte System passt die Strategie dynamisch an die Marktveränderungen an und sorgt so für kontinuierlich optimierte Renditen.

3. Exklusive institutionelle Investmentchancen: Durch die Zusammenarbeit mit Banken und institutionellen Händlern im außerbörslichen Handel (OTC) erhalten Anleger Zugang zu exklusiven Investmentkanälen und rabattierten Vermögenswerten, die in der Regel nicht öffentlich verfügbar sind.

4. Teilnahme an IPOs und SPOs: Der C-Plan ermöglicht Anlegern eine strategische Beteiligung an Börsengängen (IPO) und Kapitalerhöhungen (SPO). Diese Investments bieten attraktive Chancen, von Neubewertungen und dynamischen Kursanstiegen zu profitieren.

Relevante Bestimmungen und Sicherheiten:

1. Beteiligungsgebühr: Nach Abschluss des Projekts wird eine Gebühr in Höhe von 10 % des erzielten Gewinns als Management- und Ausführungsvergütung erhoben, um die Qualität und Nachhaltigkeit des Projekts sicherzustellen.

2. Dreistufiges Risikomanagement: Ein mehrschichtiges Kontrollsystem gewährleistet den Schutz des eingesetzten Kapitals und minimiert zugleich das Risiko für Anleger auf ein Minimum.

3. Steuerkonformität: Sämtliche Gewinne werden gemäß den deutschen Steuervorschriften ordnungsgemäß deklariert und versteuert. Guggenheim Investments unterstützt Anleger dabei mit professioneller steuerlicher Beratung und Abwicklung.

C-Plan – Ein fortschrittliches Investmentmodell:

Der C-Plan wird von Guggenheim Investments verwaltet und basiert auf dem Modell eines Private-Equity-Fonds, kombiniert mit einem KI-gestützten quantitativen Handelssystem. Diese einzigartige Struktur ermöglicht es Anlegern, von den neuesten Entwicklungen der Finanztechnologie zu profitieren und gleichzeitig Zugang zu erstklassigen institutionellen Investmentchancen zu erhalten.

„Unsere Vision ist es, die Zukunft des Investierens durch innovative und effiziente Lösungen mitzugestalten. Der C-Plan ist der erste Schritt auf diesem Weg“, so Taylor weiter.

Guggenheim Investments ist weltweit für sein Know-how im Management von Private-Equity-Fonds bekannt und bringt reichlich Expertise in festverzinslichen Wertpapieren, Aktien und alternativen Anlagen mit. Das Haus setzt langfristig auf solide Anlagestrategien und innovative Asset-Allokation für globale institutionelle Anleger und vermögende Privatkunden. Dank gründlicher Research-Systeme und scharfer Marktkenntnis genießt Guggenheim einen starken Ruf in der internationalen Vermögensverwaltung.

-

Uncategorized4 months ago

Live with Purpose Ranked #1 Show in Binge Networks’ Top 10 for July

-

Uncategorized2 months ago

Uncategorized2 months agoKirill Dmitriev: Global Investment Strategist and Architect of International Partnership

-

Entertainment & Sports1 year ago

Entertainment & Sports1 year agoRachael Sage Releases Powerful Reimagined Acoustic Album, Another Side

-

Business1 year ago

Business1 year agoGlobal Academic Excellence with XI TING’s Professional Tutor Team

-

Entertainment & Sports1 year ago

Entertainment & Sports1 year agoFrom Start to Success: 40 Stories of Successful C-Suite Executives Now Available for Pre-Order

-

Politics1 year ago

Politics1 year agoMusk Claims Trump Interview Targeted by Cyber Attack

-

Entertainment & Sports1 year ago

Entertainment & Sports1 year agoUniversity of Virginia Women’s Arena Polo Team Secures 11th National Intercollegiate Championship

-

Entertainment & Sports1 year ago

Entertainment & Sports1 year agoThousands Celebrate Lisa Vanderpump’s 7th Annual World Dog Day in West Hollywood